Crost Julian’s Charge on Credit Card: A Comprehensive Guide

Understanding the charges on your credit card is crucial for managing your finances effectively. Crost Julian’s, a popular credit card provider, offers a range of services and features. In this article, we will delve into the various charges associated with a Crost Julian’s credit card, helping you make informed decisions about your financial transactions.

Annual Fee

The annual fee is a recurring charge that you pay to maintain your Crost Julian’s credit card. The amount varies depending on the card type and the benefits it offers. For instance, premium cards often come with higher annual fees compared to standard cards. It’s essential to consider the value you receive from the card in terms of rewards, cashback, and other perks before deciding whether the annual fee is justified.

| Card Type | Annual Fee |

|---|---|

| Standard Card | $0 |

| Premium Card | $99 |

| Platinum Card | $199 |

Interest Rate

The interest rate on your Crost Julian’s credit card is a critical factor to consider. It determines the cost of borrowing money using your card. The interest rate can vary based on factors such as your credit score, the card type, and market conditions. Understanding the interest rate helps you manage your credit card debt effectively and avoid paying excessive interest charges.

Here’s a breakdown of the interest rates for different Crost Julian’s credit cards:

| Card Type | Interest Rate |

|---|---|

| Standard Card | 12.99% – 22.99% |

| Premium Card | 9.99% – 19.99% |

| Platinum Card | 7.99% – 17.99% |

Transaction Fees

Transaction fees are charges imposed on certain types of transactions made with your Crost Julian’s credit card. These fees can vary depending on the nature of the transaction. Common transaction fees include foreign transaction fees, cash advance fees, and balance transfer fees.

Foreign Transaction Fee

When you use your Crost Julian’s credit card for purchases in a foreign currency, a foreign transaction fee may apply. This fee is typically a percentage of the transaction amount. It’s important to check the fee percentage before traveling abroad to avoid unexpected charges.

Cash Advance Fee

Cash advances involve borrowing money from your credit card’s available credit limit. Crost Julian’s charges a cash advance fee, which is usually a percentage of the cash advance amount. This fee can be higher than the interest rate on purchases, so it’s advisable to use cash advances sparingly.

Balance Transfer Fee

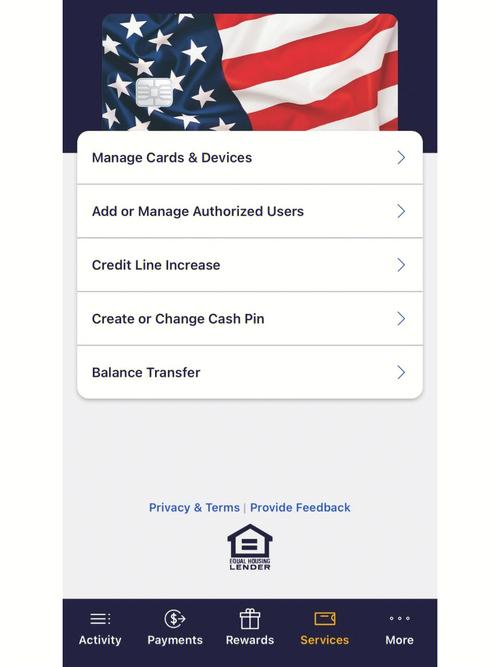

Balance transfers involve transferring an existing credit card balance to your Crost Julian’s credit card. Crost Julian’s may charge a balance transfer fee, which can be a percentage of the transferred balance. This fee can help you consolidate debt and potentially lower your interest rate, but it’s important to consider the overall cost before making a balance transfer.

Grace Period

The grace period is the time frame during which you can pay your credit card bill in full without incurring interest charges. Crost Julian’s offers a standard grace period of 21 days. However, it’s crucial to pay your bill on time to avoid missing the grace period and incurring interest charges.

Overlimit Fee

Using your credit card above its credit limit can result in an overlimit fee. Crost Julian’s charges a fee for exceeding your credit limit, which can vary depending on the card type. It’s important to monitor your credit card balance and avoid exceeding your credit limit to avoid unnecessary fees.

Reporting to Credit Bureaus

Crost Julian’s reports your payment history, credit utilization, and other relevant information to credit bureaus. Maintaining a good credit score is