Annual Return Date Cro: A Comprehensive Guide

Understanding the concept of annual return date, also known as the “cro” date, is crucial for investors and financial professionals. This date signifies the deadline for shareholders to receive their dividends or other distributions from a company. In this article, we will delve into the various aspects of the annual return date cro, providing you with a detailed and multi-dimensional introduction.

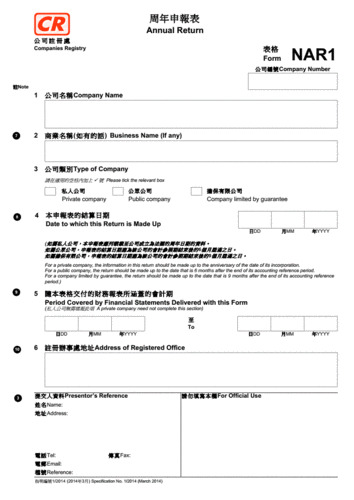

What is the Annual Return Date Cro?

The annual return date, often referred to as the “cro” date, is the date on which a company distributes its profits to its shareholders. This distribution can take the form of dividends, stock splits, or other forms of returns. It is an important date for investors as it determines their eligibility to receive these distributions.

Why is the Annual Return Date Cro Important?

The annual return date cro holds significant importance for several reasons. Firstly, it ensures that shareholders receive their fair share of the company’s profits. Secondly, it provides transparency and accountability in the distribution process. Lastly, it helps investors plan their financial strategies and investments accordingly.

How is the Annual Return Date Cro Determined?

The annual return date cro is determined by the company’s board of directors and is usually announced in the company’s financial statements. It is typically set for a specific date within a certain timeframe, such as within 30 to 60 days after the end of the fiscal year. The exact date may vary depending on the company’s policies and regulations.

Eligibility for the Annual Return Date Cro

Only shareholders who hold shares on the record date, which is usually a few days before the annual return date cro, are eligible to receive the distributions. This means that if you purchase shares after the record date, you will not be entitled to the distributions for that particular year. It is essential to keep track of the record date to ensure your eligibility.

Impact of the Annual Return Date Cro on Investment Decisions

The annual return date cro can have a significant impact on investment decisions. Investors often consider the potential returns from dividends and distributions when evaluating a company’s investment potential. By knowing the annual return date cro, investors can plan their investments accordingly and maximize their returns.

Table: Annual Return Date Cro for Selected Companies

| Company | Annual Return Date Cro |

|---|---|

| Company A | March 31st |

| Company B | April 30th |

| Company C | May 15th |

Factors Influencing the Annual Return Date Cro

Several factors can influence the annual return date cro. These include the company’s financial performance, regulatory requirements, and internal policies. For instance, if a company has a strong financial year, it may decide to distribute higher dividends, resulting in an earlier annual return date cro. Conversely, if the company faces financial difficulties, it may delay the distribution, leading to a later annual return date cro.

Impact of the Annual Return Date Cro on Stock Price

The annual return date cro can also have an impact on the stock price. In anticipation of the distribution, investors may buy shares, leading to an increase in demand and potentially driving up the stock price. Conversely, after the distribution, investors may sell their shares, resulting in a decrease in demand and potentially causing the stock price to decline.

Conclusion

In conclusion, the annual return date cro is a crucial aspect of a company’s financial operations. Understanding its significance, determination, eligibility, and impact on investment decisions can help investors make informed decisions and maximize their returns. By keeping track of the annual return date cro, investors can ensure they receive their fair share of the company’s profits and plan their investments accordingly.