Bank of China Canada: A Comprehensive Overview

Are you considering banking services in Canada and looking for a reliable institution? Look no further than the Bank of China Canada. With a rich history and a strong presence in the Canadian financial landscape, this bank offers a wide range of services to cater to the diverse needs of its customers. Let’s delve into the various aspects of Bank of China Canada to understand what it has to offer.

History and Background

The Bank of China, originally established in 1912, has grown to become one of the largest banks in the world. Its Canadian branch, Bank of China Canada, was established in 1979. Over the years, it has expanded its operations and now has a network of branches and ATMs across the country.

Services Offered

Bank of China Canada provides a comprehensive range of services to its customers, including:

-

Personal Banking: From savings and checking accounts to credit cards and personal loans, Bank of China Canada offers a variety of personal banking solutions to meet your financial needs.

-

Business Banking: The bank caters to the needs of small and medium-sized enterprises with a range of business banking services, including business accounts, loans, and credit facilities.

-

Corporate Banking: Bank of China Canada offers tailored corporate banking solutions to meet the needs of large corporations, including trade finance, cash management, and investment banking services.

-

Foreign Exchange: With a strong presence in the global financial market, Bank of China Canada provides competitive foreign exchange rates and services to its customers.

-

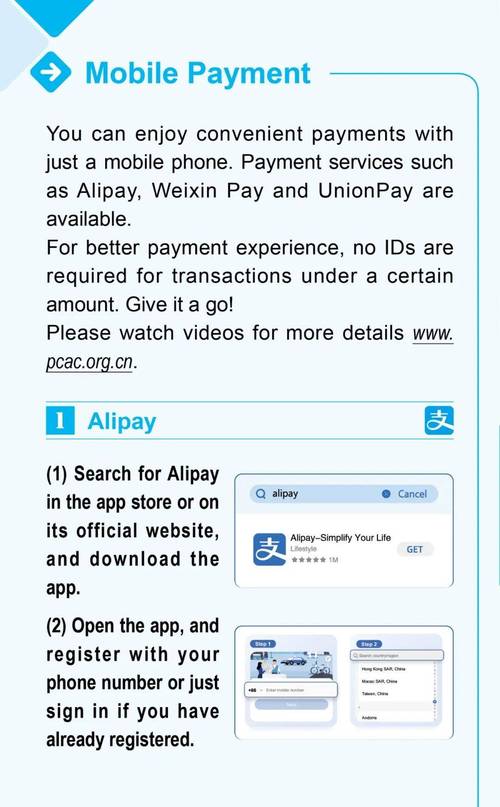

Online and Mobile Banking: The bank offers a user-friendly online and mobile banking platform, allowing customers to manage their accounts, make transactions, and access financial information on the go.

Branch Network and ATM Locations

Bank of China Canada has a well-distributed network of branches and ATMs across Canada. The following table provides a breakdown of the number of branches and ATMs in different provinces:

| Province | Number of Branches | Number of ATMs |

|---|---|---|

| British Columbia | 5 | 20 |

| Alberta | 4 | 15 |

| Saskatchewan | 3 | 10 |

| Manitoba | 2 | 5 |

| Ontario | 10 | 30 |

| Quebec | 5 | 20 |

| New Brunswick | 2 | 5 |

| Prince Edward Island | 1 | 3 |

| Newfoundland and Labrador | 2 | 5 |

Customer Support

Bank of China Canada understands the importance of customer support and offers various channels for assistance:

-

Phone Support: Customers can reach out to the bank’s customer service team through phone calls, where they can get help with account inquiries, transaction issues, and more.

-

Email Support: For non-urgent matters, customers can send an email to the bank’s customer service department, and they will respond promptly.

-

Branch Visits: Customers can visit their nearest branch for face-to-face assistance with any banking-related concerns.

Technology and Innovation

Bank of China Canada is committed to leveraging technology to enhance its services and customer experience. The bank has invested in various technological advancements, including:

- <