Cro Balance Sheet: A Comprehensive Overview

Understanding the balance sheet of a company like Cro is crucial for investors, analysts, and stakeholders. It provides a snapshot of the financial health and performance of the company. Let’s delve into the various aspects of Cro’s balance sheet, examining its assets, liabilities, and equity in detail.

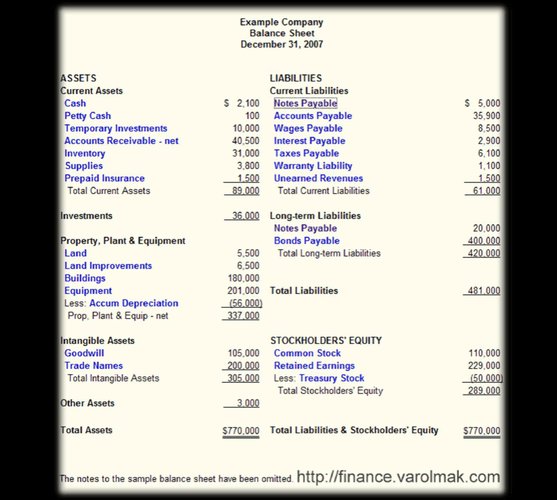

Assets

Assets are the resources owned by a company that have economic value. They can be categorized into current assets and non-current assets.

| Current Assets | Amount (in millions) |

|---|---|

| Cash and Cash Equivalents | $50 |

| Accounts Receivable | $100 |

| Inventory | $150 |

| Prepaid Expenses | $20 |

| Total Current Assets | $320 |

Non-current assets include property, plant, and equipment, intangible assets, and long-term investments.

| Non-Current Assets | Amount (in millions) |

|---|---|

| Property, Plant, and Equipment | $500 |

| Intangible Assets | $200 |

| Long-term Investments | $100 |

| Total Non-Current Assets | $800 |

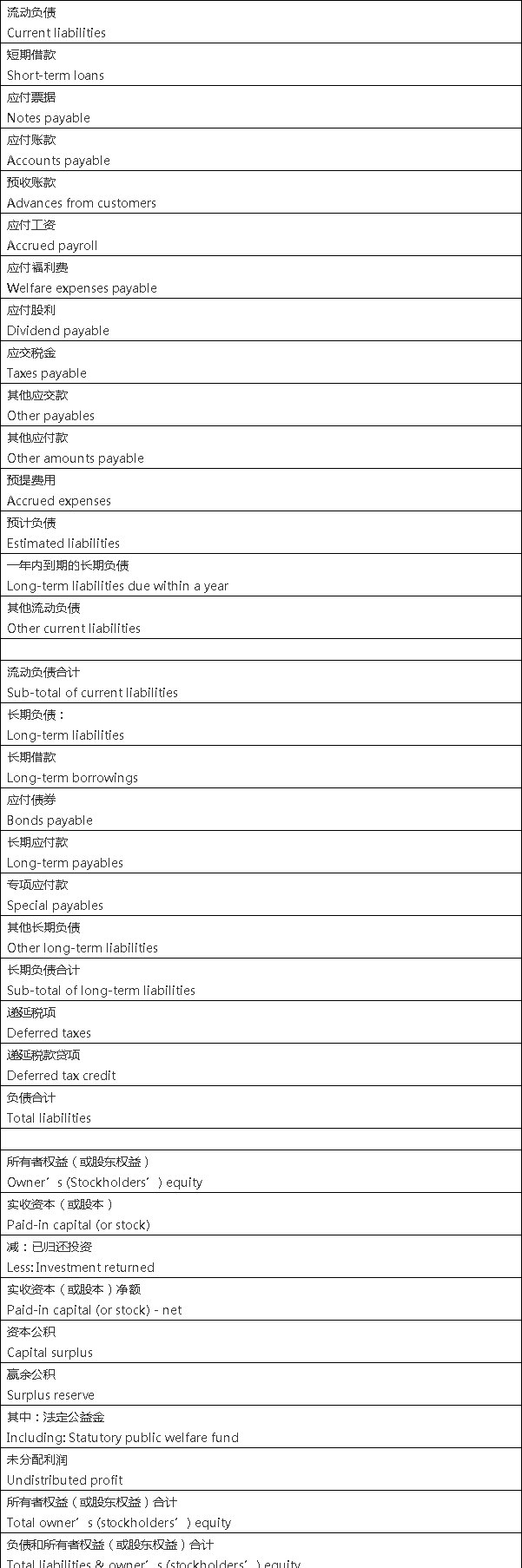

Liabilities

Liabilities are the obligations of a company that arise from past transactions or events. They can be classified into current liabilities and long-term liabilities.

| Current Liabilities | Amount (in millions) |

|---|---|

| Accounts Payable | $200 |

| Short-term Debt | $150 |

| Current Portion of Long-term Debt | $50 |

| Total Current Liabilities | $400 |

Long-term liabilities include long-term debt and deferred tax liabilities.

| Long-term Liabilities | Amount (in millions) |

|---|---|

| Long-term Debt | $300 |

| Deferred Tax Liabilities | $100 |

| Total Long-term Liabilities | $400 |

Equity

Equity represents the ownership interest in a company. It is calculated by subtracting liabilities from assets.

Equity = Assets – Liabilities

Based on the information provided, Cro’s equity can be calculated as follows:

Equity = ($320 million + $800 million) – ($400 million + $400 million) = $720 million

This indicates that Cro has a strong equity position, which is a positive sign for investors and stakeholders.

Financial Ratios

Financial ratios provide insights into the financial performance and stability of a company. Let’s examine some key ratios for Cro.

Current Ratio

The current ratio measures a company’s ability to cover its short-term liabilities with its short-term assets.

Current Ratio = Current Assets / Current Liabilities

For Cro, the