Cro Coin Candlestick Chart: A Comprehensive Guide

Understanding the candlestick chart for Cro Coin is essential for anyone looking to make informed decisions in the cryptocurrency market. This guide will delve into the intricacies of the chart, providing you with a multi-dimensional perspective.

What is a Candlestick Chart?

A candlestick chart is a type of financial chart used to track the price movements of a security over time. It is particularly popular in the cryptocurrency market due to its ability to provide a clear visual representation of price trends.

The chart consists of four main components: the open, high, low, and close prices. These are represented by a “body” and “wicks” on the chart. The body shows the range between the open and close prices, while the wicks show the range between the high and low prices.

Reading the Cro Coin Candlestick Chart

Now that we understand the basics of a candlestick chart, let’s focus on Cro Coin. Here’s how to read the chart effectively:

Body Color

The color of the body indicates whether the price closed higher or lower than it opened. A green or white body suggests that the price closed higher than it opened, indicating a bullish trend. Conversely, a red or black body indicates that the price closed lower than it opened, suggesting a bearish trend.

Wicks

The wicks, or “shadows,” represent the highest and lowest prices reached during the trading period. A long upper wick indicates that the price reached a high point but then fell back. A long lower wick suggests that the price reached a low point but then rose.

Doji Candlestick

A doji candlestick occurs when the open and close prices are nearly equal. This indicates uncertainty in the market and can be a sign of potential reversal.

Bullish and Bearish Patterns

Bullish patterns, such as the bullish engulfing or the morning star, suggest that the price is likely to rise. Bearish patterns, such as the bearish engulfing or the evening star, suggest that the price is likely to fall.

Interpreting the Cro Coin Candlestick Chart

Now that we know how to read the chart, let’s discuss how to interpret it for Cro Coin.

Support and Resistance

Support and resistance levels are critical in the cryptocurrency market. These levels indicate where the price is likely to find support or face resistance. By identifying these levels on the candlestick chart, you can make more informed trading decisions.

Support levels are where the price has repeatedly fallen but then reversed. Resistance levels are where the price has repeatedly risen but then reversed.

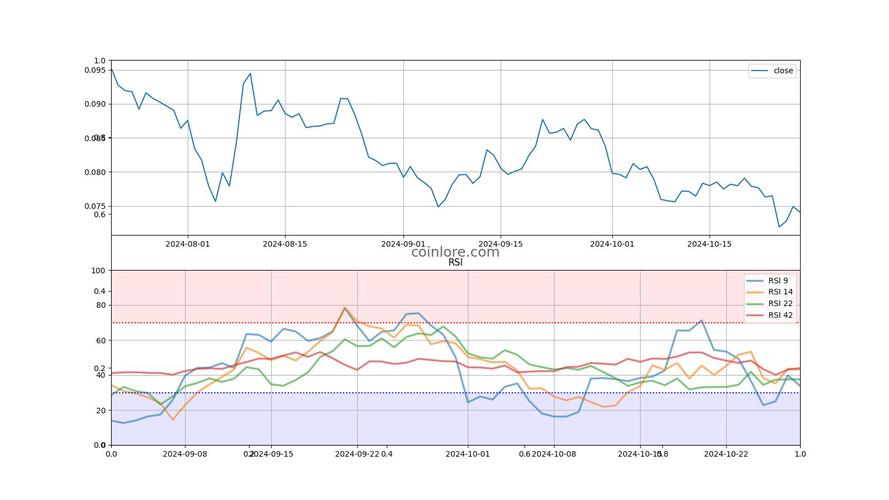

Trend Analysis

By analyzing the trend of the candlestick chart, you can determine whether Cro Coin is in an uptrend, downtrend, or sideways trend. An uptrend is characterized by higher highs and higher lows, while a downtrend is characterized by lower highs and lower lows. A sideways trend is characterized by roughly equal highs and lows.

Volume Analysis

Volume is another critical factor to consider when analyzing the candlestick chart. A high volume indicates strong interest in the cryptocurrency, while a low volume suggests weak interest.

Conclusion

Understanding the Cro Coin candlestick chart is essential for anyone looking to trade this cryptocurrency. By analyzing the chart’s various components, you can gain valuable insights into the market and make more informed trading decisions.

| Component | Description |

|---|---|

| Body | Indicates the range between the open and close prices. |

| Wicks | Indicates the range between the high and low prices. |

| Doji | Indicates uncertainty in the market and potential reversal. |

| Bullish Patterns | Suggests that the price is likely to rise. |

| Bearish Patterns | Suggests that the price is likely to fall. |

Remember, while the candlestick chart can provide valuable insights, it is essential to combine it with