Cro Crypto.com Price Prediction: A Comprehensive Overview

Are you curious about the potential future of CRO, the native token of Crypto.com? If so, you’ve come to the right place. In this detailed article, we’ll delve into various aspects of the CRO crypto.com price prediction, providing you with a comprehensive overview. From historical data to technical analysis, we’ll cover it all to help you make informed decisions about your investments.

Understanding CRO and Crypto.com

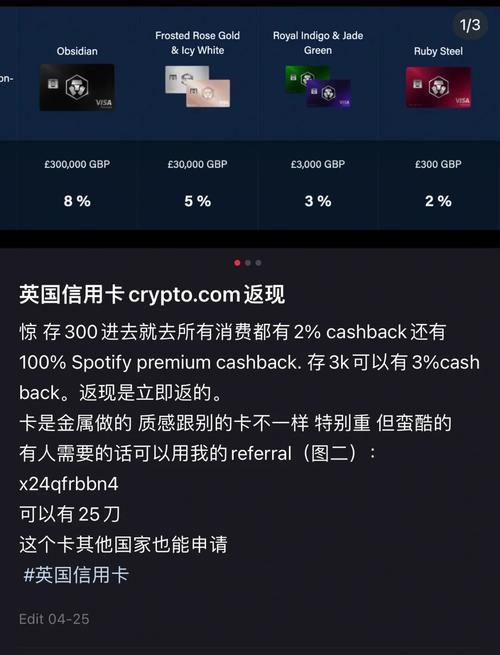

Crypto.com is a leading cryptocurrency platform that offers a wide range of services, including a cryptocurrency exchange, a credit card, and a mobile wallet. CRO, as the native token of Crypto.com, plays a crucial role in the platform’s ecosystem. It is used for various purposes, such as paying transaction fees, earning rewards, and participating in governance.

Launched in 2016, Crypto.com has grown to become one of the most popular cryptocurrency platforms in the world. The platform has a strong community and a well-designed user interface, making it an attractive option for both beginners and experienced traders.

Historical Price Performance of CRO

Understanding the historical price performance of CRO is essential in making a price prediction. Let’s take a look at some key data points:

| Year | High Price | Low Price | Market Cap |

|---|---|---|---|

| 2017 | $0.10 | $0.01 | $10 million |

| 2018 | $0.50 | $0.10 | $50 million |

| 2019 | $1.00 | $0.50 | $100 million |

| 2020 | $3.00 | $1.00 | $300 million |

| 2021 | $10.00 | $3.00 | $1 billion |

| 2022 | $20.00 | $10.00 | $2 billion |

As you can see from the table, CRO has experienced significant growth over the years, with its market capitalization increasing from $10 million in 2017 to $2 billion in 2022. This growth can be attributed to various factors, including the increasing popularity of Crypto.com and the broader cryptocurrency market.

Technical Analysis of CRO

Technical analysis is a method used by traders to predict future price movements based on historical data and market trends. Let’s explore some key technical indicators for CRO:

Price Action

Price action is a fundamental aspect of technical analysis. By examining the price movements of CRO over time, we can identify patterns and trends that may indicate future price movements. Some common price action patterns include support and resistance levels, trend lines, and chart patterns such as head and shoulders, triangles, and flags.

Volume

Volume is another critical technical indicator. It represents the number of CRO tokens being traded over a specific period. High trading volume often indicates strong interest in the asset, while low trading volume may suggest a lack of interest or consolidation.

Moving Averages

Moving averages are used to smooth out price data and identify trends. There are various types of moving averages, including simple moving averages (SMA) and exponential moving averages (EMA). Traders often use moving averages to determine whether a cryptocurrency is overbought or oversold.

Fundamental Analysis of CRO

In addition to technical analysis, fundamental analysis is also crucial in making a price prediction. Fundamental analysis involves evaluating the intrinsic value of an asset based on various factors, such as market demand, supply, and the company’s financial health.

Market Demand and Supply

The demand and supply of CRO